U.S. Military Aid to Ukraine: Investment Returns and Emerging Trends

Why Aid to Ukraine is a Good Investment From a Purely Financial Perspective

Related Articles: Drones in Ukraine, NATO and Russia, The Counterintuitive Effect of Israel’s Strike Success, Israel and US, and A Hypothetical Invasion of Taiwan.

This is part one of a two-part series: Ukraine Aid Part Two

Russia’s full-scale invasion of Ukraine in 2022 prompted an unprecedented wave of U.S. security assistance. Since 2022, Congress had approved roughly $175 billion in emergency aid for Ukraine and neighboring countries – far more than for any conflict in recent memory. While this aid is often justified in moral and strategic terms, it also functions as a massive investment in the U.S. defense sector. A large share of the funding is spent domestically, financing American weapons production and creating jobs for workers who can produce those weapons. The resulting surge in arms sales abroad has effectively paid back much of Washington’s expenditure. In fact, preliminary analyses suggest that U.S. military aid to Ukraine may be yielding a positive return on investment (ROI) for the federal government, on par with or even exceeding typical stock market returns. That said, Trump’s current actions can endanger this golden goose as less allies trust the U.S. and so will purchase less military equipment.

The countries around the world delivering aid to Ukraine. Source Wikipedia.

Economic Returns: Aid as a Profitable Investment

From a budgetary perspective, U.S. aid to Ukraine can be viewed not just as an expense but as a catalyst for revenue. About $128 billion from the US government directly supports the Ukrainian government and war. However, a large share of the aid actually flows back into the U.S. economy. When Washington sends artillery rounds or Javelin missiles to Kyiv, it often pays American defense contractors to produce replacements. One analysis found Ukraine aid is funding defense manufacturing in over 70 U.S. cities, as factories ramp up to backfill inventory and fulfill new orders. In this way, the aid packages double as stimulus for the U.S. defense-industrial base.

The war has also dramatically boosted global demand for U.S.-made weapons, creating a revenue windfall. U.S. foreign military sales and direct commercial arms sales hit a record high in 2024, reaching $317 billion in combined value. For comparison, U.S. arms exports in 2021 (before the invasion) were approximately $138 billion. This means the annual arms trade volume jumped by roughly $180 billion during the first two years of the war. American defense firms are receiving orders not only from Ukraine but from allies worldwide who are arming up in response to Russia’s aggression. Europe’s arms imports nearly doubled between 2014–18 and 2019–23, and an estimated 55% of those imports were supplied by the United States, up from 35% in the previous five-year period. With Russia largely sidelined as an exporter – its arms exports have plummeted by over 50% due to the war and sanctions – the U.S. has moved into an even stronger position as the world’s top arms supplier, accounting for about 42% of global major arms exports.

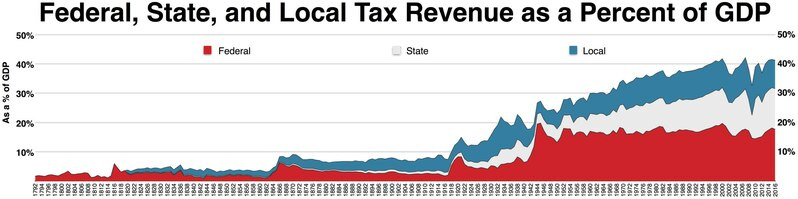

The tax revenues and economic activity generated by this surge help offset the aid’s fiscal cost. For example, foreign arms sales contribute to U.S. corporate profits, worker incomes, and manufacturing output – all of which produce federal tax receipts. Economists’ estimate that roughly 20¢ of every $1 in added GDP returns to the government as based on total U.S. government receipts equal to around 25% of GDP.

Government Taxes as a Percent of GDP. While this number is close to 40%, I want to ignore local taxes and be conservative, so I model a one-dollar increase of GDP due to defense exports to lead to a 20-cent increase in taxes. Source Wikipedia.

By that metric, the U.S. government recoups significant funds when American defense exports rise. If the war-driven increase in annual arms sales is on the order of $50–$70 billion in sustained new demand (after subtracting temporary wartime spikes), it could translate into around $10+ billion per year in extra tax revenue. Indeed, detailed modeling of the Ukraine aid trade found that after-tax returns to the U.S. Treasury could equate to a 10–15% annual ROI on the aid provided (See here for analysis). In simple terms, the U.S. may profit from financing Kyiv’s defense as they could pay borrowing at approximately 4% interest to fund aid that indirectly returns over 10% through boosted tax revenues. Of course the US government isn’t in the business of making money and so this should not be the only reason to give aid. However, this does suggest that there is a financial benefit to this aid as well.

Even if we don’t consider the impact of weapon sales, US GDP tends to benefit in times of conflict as the country and it’s economic base is usually far away from the conflict zone, so less destruction of its economy occurs. Source: Global Economic Burden of Violent Conflict.

It is important to note the limits of this analysis. The high returns from U.S. military aid to Ukraine are tied to current levels of demand and cannot be extrapolated indefinitely – for example injecting $1 trillion into Ukraine would not yield proportional returns, as the global arms market has natural limits. Furthermore, these observations focus on economic outcomes and do not account for the broader foreign-policy considerations, which fall outside a standard ROI. Available data indicate that U.S. military aid to Ukraine has provided substantial benefits for the United States. The aid has increased visibility and demand for U.S. defense systems – and the advertised performance of American weapons against Russia has translated into multi-billion dollar orders that ultimately benefit the U.S. government’s bottom line.

Looking at the data since 2022, Ukraine has become the top recipient of U.S. aid which appears to have been strategically and economically favorable investment for United States. The infusion of funding into Ukraine’s defense translated into surging global demand for U.S. weapons, effectively generating new tax revenue that offset the aid’s costs. The current aid program could yield an estimated 10-15% annual return to the U.S. Treasury when factoring in increased arms-production activity and associated taxes. This outcome, while counterintuitive, highlights how deeply entwined America’s strategic commitments and its industrial/economic interests can be. Support for Ukraine not only furthers foreign policy goals but also stimulates domestic business – a synergy that makes the aid politically more sustainable. Indeed, the U.S. has managed to strengthen a frontline democracy against Russian aggression at little to no net fiscal cost, or even a net economic gain.

Read part two of this series here

Notes: This is my own opinion and not the opinion of my employer, State Street, or any other organization. This is not a solicitation to buy or sell any stock. My team and I use a Large Language Model (LLM) aided workflow. This allows us to test 5-10 ideas and curate the best 2-4 a week for you to read. Rest easy that we fact-check, edit, and reorganize the writing so that the output is more engaging, more reliable, and more informative than vanilla LLM output. We are always looking for feedback to improve this process.

Additionally, if you would like updates more frequently, follow us on x: https://x.com/cameronfen1. In addition, feel free to send me corrections, new ideas for articles, or anything else you think I would like: cameronfen at gmail dot com.